Those with a keen interest in finance will have noted the publication on Monday 14th April of “Flash Boys” by Michael Lewis, an accomplished writer and analyst of financial matters. The book is written with Mr Lewis’s customary flair and it has garnered significant press coverage for exposing some of the intricacies of high-frequency trading (HFT).

We greatly welcome the exposure that is now being placed on HFT and we will make our position on the subject clear: we believe HFT to be detrimental to the interests of all investors and represents yet another example of financial institutions abusing their clients’ trust and acting against them.

In fact the exposure of HFT reveals that not only did these large banks act against their client’s interests they also actively aided and profited from allowing other financial institutions to abuse their clients.

What HFT actually is can be complicated to describe in detail but the basic mechanisms are straightforward and the activity can be encapsulated by one word: scalping – profiting from small movements in prices. In order to provide some context about the scale of the problem over 50% of most stock exchange transactions are HFT transactions.

The common perception is that, when Mr X places an order to buy an investment in the UK, a button is pressed on a keyboard in front of a computer screen showing a certain price and that order is then settled on the London Stock Exchange. The reality does not match this perception.

Firstly there is no longer a solitary exchange upon which transactions are made. In the US there are currently 46 open exchanges, the UK has several. In addition to this there are what are known as “dark pools” created by banks in theory to ensure confidentiality for financial institutions when making big trades. The logic for this is as follows: Bank A has a large holding in a company it wants to sell, if it openly reveals the desire to trade on an exchange competitors would see the order and would try to sell stock to drive down the price so they could then profit when they buy the shares back from Bank A at a lower price. The dark pools are intended to shield investors from being exposed to high-frequency traders but in reality they are like pike, silently populating the depths. In some only 15% of the trades are “real” with the rest HFT trades. The interactions between these various exchanges and liquidity pools is complex but the critical element is simply that there are a multiple of exchanges where any order can be placed. Once Mr X’s order button is pressed software directs the order to whichever exchange currently has a counterparty to the order – someone who wishes to sell a sufficient quantity of the same investment Mr X wishes to buy.

High-frequency trading is in effect a software driven or algorithmic trade using incredibly fast processors that firstly spots Mr X’s order in transit to the exchanges and then in a miniscule fraction of time undertakes trades which increase the amount that Mr X has to pay for the shares. The HFT trader profits from the difference between the price that existed in the market before the trade was placed and the eventual higher price that Mr X has to pay.

This in itself would seem unfair to most people. What amplifies this is that the banks and exchanges and other financial institutions are actively colluding in this process.

HFT traders rely on breath-taking speed. The data of Mr X’s trade is identified and acted upon in under 30 milliseconds or ten times faster than the blink of an eye. We tend to think of information flowing fairly instantly these days but even using fibre-optic cable the signal is limited to the speed of light and is reduced by the number of times the signal bounces on the sides of the cable. The greatest impact upon the speed that the data travels is the distance from the exchange the signal starts. It is here the HFT arms-race takes place. Initially, in order to ensure that the HFT traders could create their speed advantage, they used to locate their servers as close the stock-exchanges as they could. As others did the same their relative speed advantage diminished. So they paid the stock exchanges to host or “co-locate” their servers inside the actual exchanges. The race was then to make sure that the HFT’s servers were on the racks closest to where the information came in. Now micro-wave data transmission is the new mechanism for ensuring the HFT’s get their data first. Other technologies will emerge and be exploited in due course.

Other approaches were also used. The HFT traders would pay banks for their “flow” – the bank would profit from selling the information about its clients trades before they hit the exchanges giving the HFT trader sufficient time to act against the bank’s client. The clients – individuals, pension funds and investment firms – were not made aware of this.

The profitability of HFT is largely unknown – some participants claim it is minimal. However if they were each willing to pay tens of millions of pounds a year to access the fastest fibre-optic cables and hundreds of millions of pounds a year to buy the “flow” it seems a safe assumption to make that billions of pounds of profits a year were being made at the expense of the general public.

HFT traders claim that they provide liquidity and are beneficial to the orderly functioning of capital markets. This is laughable (and also contrary to the extensive academic work on the subject). Capital markets exist to provide a smooth mechanism for people to invest in businesses. When the HFT traders typical holding period for their “investment” is measured in single digit milliseconds it is self-evident that their purpose is simply to profit from the transaction.

Blackwood completely rejects the methodology and the mindset that results in such behaviour. We are low-frequency traders. Our clients’ typical holding period for investments is measured in years and decades and we ensure that when transactions are made they are undertaken away from institutions that will sell the “flow”.

High-frequency trading is symptomatic of the cancer that pervades financial institutions where they are motivated and hungry abusers of their own clients. It is not the first such mechanism for doing this and will not be the last, but our emotional response remains one of dismay and disgust.

The publication of the book will prompt a response, hopefully even a regulatory one, but this is not a new problem and it is frustrating that the regulation is so slow to react to markets being so clearly rigged against the public.

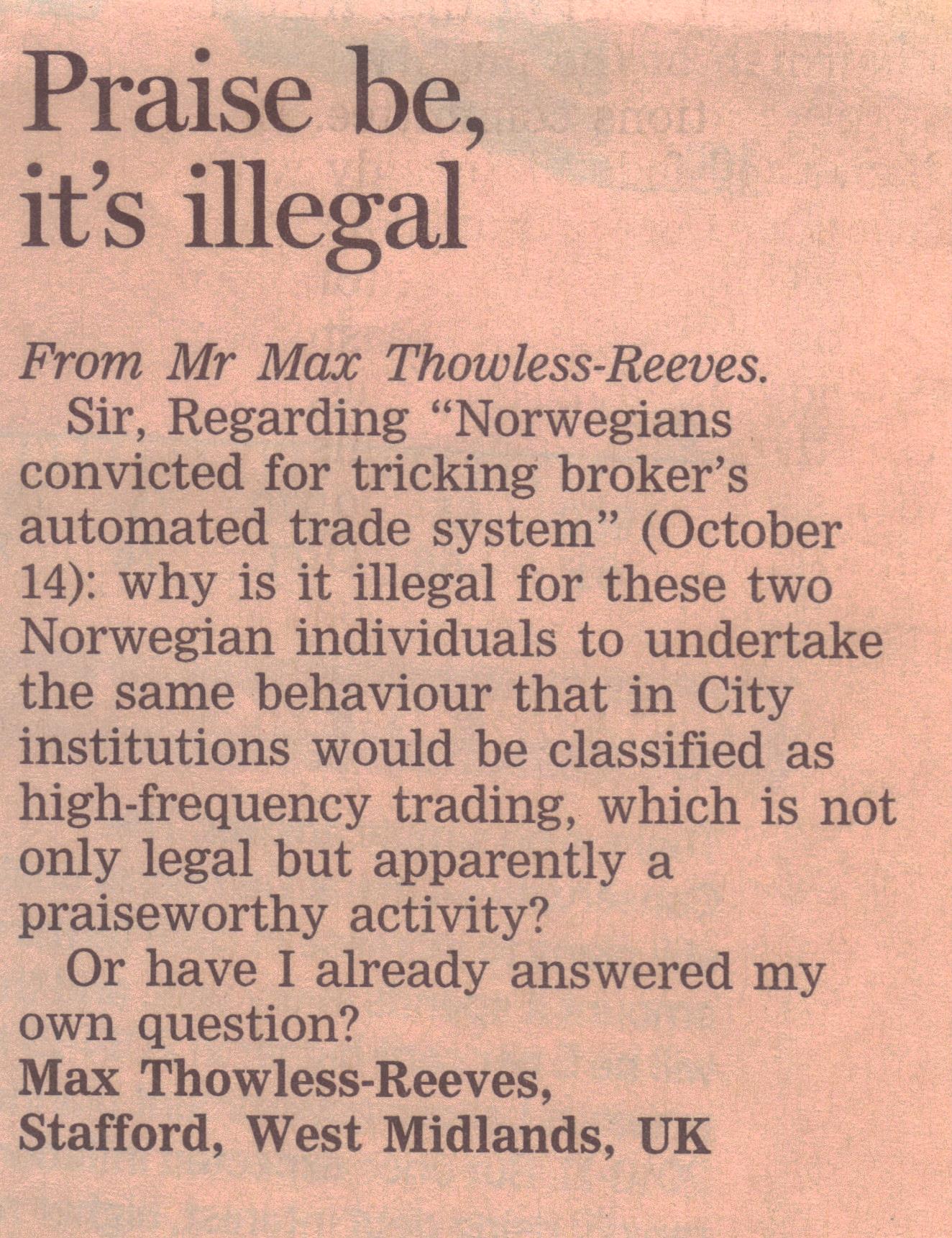

We have been aware of the fact and the dangers of HFT for many years. In October 2010 there was an article in the Financial Times which to us highlighted the discrepancy with high-frequency trading not being viewed for what it was. The first paragraphs of the article were:

“Two Norwegian day traders have been handed suspended prison sentences for market manipulation after outwitting the automated trading system of a big US broker.

The two men worked out how the computerised system would react to certain trading patterns – allowing them to influence the price of low-volume stocks.”

One of our directors (Max Thowless-Reeves) was quoted in the letters page the following day (right):