SEPTEMBER 2020 MARKET UPDATE

If the calendar quarters of 2020 could be likened to films then Q1 would be the Towering Inferno – the prospect of calamitous loss of life transmuted when they blow up the water tanks in the roof in the final reel to quench the flames. Q2 was more like Risky Business (the early career Tom Cruise film) where, in the teeth of impending disaster, everything comes good in the end in a heart-warming and perhaps naive coming of age drama. Q3 has been more reminiscent of a turgid, seemingly never-ending, experimental black and white eastern European film from the 1960’s; hours pass but very little happens.

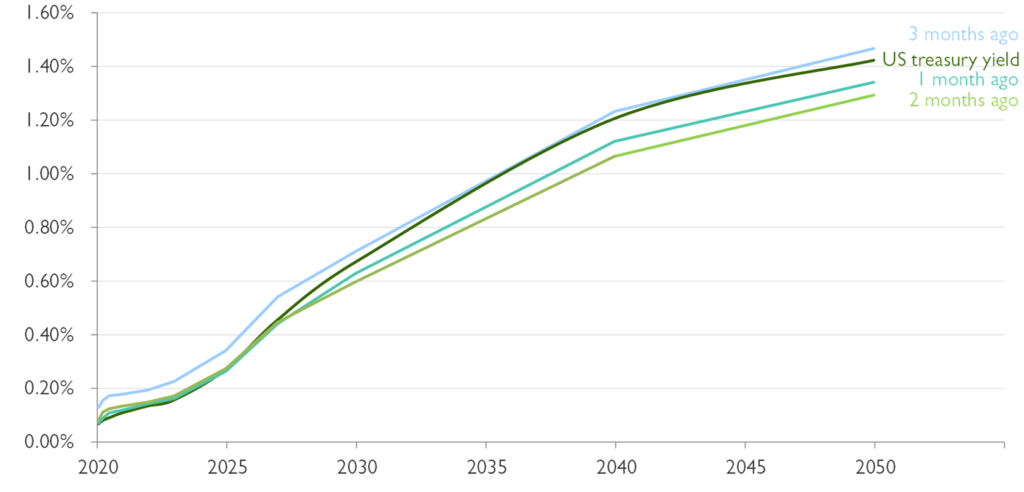

The causes of Q1 and Q2 volatility are well understood: pandemic then panic then response then recovery etc. During Q3 equity markets were flat, debt markets were flat, gold was flat, sterling was flat. We have had some pockets of interest – the surging price of Tesla, the collapse in fraud of Wirecard, the goings on at Nikola (named after Nikola Tesla, as if we had further stomach for the man) where the company was at one point valued at $35bn before a single truck had rolled down its assembly line. But, these lowlights apart, the period has been strangely calm. The reason for this can be seen in one graph (below). This is the US treasury yield curve (the yields investors can get from investing in US government bonds over different durations). In the graph you can see today’s yield and that from one month, two months and three months ago. They are basically identical: there is no movement in the yields or the shape of the yield curve.

This is both highly unusual and deliberate. Unusual in that US treasuries are one of the most highly traded and liquid assets in the world – they usually display variation over time in some dimension – but here they have been locked in an iron grip by the Federal Reserve.

In the teeth of the pandemic meltdown in late March liquidity in the US treasury market dried up and caused some erratic behaviour. The Fed reacted to inject even more liquidity than had been deployed in the financial crisis to stave off the potential crisis but has retained its grasp to the extent that speculative trading of the US treasury market has basically ceased. Even professional treasury traders have accepted that, for now, there is no angle to be played, that the yield curve is not going to move and thereby present them with an opportunity to profit.

In a world both awash with and dominated by debt, then the irresistible force of the immobile US treasury becomes the immovable object of equity markets. There has been some rotation in the US both into the tech stocks that have been driving the market forwards (Facebook, Alphabet (Google), Amazon, Apple, Netflix and Microsoft, though now also including Tesla and Zoom) and then away from them – leaving markets steady. The Fed clamping US Treasury volatility down has smothered all other asset classes.

After the roller coaster ride of Q1 and Q2 we are relieved that Q3 has brought some calm, but it reiterates and reinforces the central truth about markets: they are being driven by government’s response to the Covid pandemic and by the Fed – valuations are in effect irrelevant right now. The relaxing or tightening of the Fed’s control of this crucial asset price determinant (Treasury yields) will be the driving force for the direction of all other asset classes and the only thing that counts. When this tight grip yields, as it must at some point, then it is hard to foresee whether this will be immediately positive or negative for equity markets. Our job is less about predicting the unpredictable than in trying to maintain resilience whatever the future brings. Our investment strategies have been performing commendably during this deeply uncertain period and we remain conservatively positioned with considerable cash and sovereign debt resources at our disposal for when markets start moving again.